Don't let your tax & financial filings get in the way of building the business of your dreams.

Expert tax and bookkeeping support for businesses who want to stay tax compliant and grow faster.

- Avoid tax surprises & filing mistakes that can impact your growth

- Understand your tax obligations & stay compliant with the IRS

- Get expert financial advice to grow your business faster

With 5,000+ clients strong, we’re experts in tax compliance, making it pain-free and within reach.

You’re in good company

Your whole life has been about this —getting your company from startup, to funding, all the way to (fingers crossed!) exit.

Now, if you want to stay compliant with the IRS, you need reliable experts to help you navigate the complexities of U.S. tax laws. Not only are our accountants IRS Enrolled Agents, but they also have years of experience working with business owners around the world.

We care about your business, and it shows.

At Cleer Tax, we’re more than just a service provider – we’re your dedicated long-term accounting partner.

Our team of experienced book keepers and accountants provides tailored support to help you grasp the ins and outs of your business and tax compliance.

Say goodbye to generic responses and one-size-fits-all tax returns. With a dedicated team handling all your accounting requirements, you’ll experience the personalized attention and expertise that make it feel like you have your very own in-house accounting department working tirelessly for your business.

We optimize your taxes now to prepare your company for growth.

To be successful, you need to think ahead. You need us to think ahead for you.

We identify the most effective tax optimization strategies that will not only boost your growth now but fuel your growth for years to come.

Our pricing is startup-friendly, to keep your runway long.

While tax and bookkeeping may not be traditional centers for growth, our transparent, flat-fee pricing makes it easy to get back more than you put in. We aim to support you, not shorten your runway. Because more overhead is a risk to your success, and we’re here to help you grow.

Plus, our extensive experience ensures you file all the right paperwork, on time, and pay the least amount possible to stay compliant.

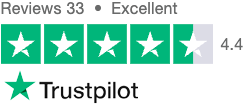

Our customers say it best

Our track record speaks for itself.

For over half a decade, helped entrepreneurs take care of their books and taxes.

Thousands of startups, small, and growing businesses choose Cleer as their trusted financial partner.

Teams from all over the world have used our accounting services to accelerate growth.

Our tax pros can assist C-Corps, S-Corps, and LLCs incorporated in states across the U.S.

How we help businesses.

FREE RESOURCE

Business Tax Calendar

We’ve created this handy widget to keep track of important business tax deadlines for your startup that you can automatically add to your calendar. Get your…

- Filing Deadlines

- Extension Dates

- Tax Payment Dates