Key Takeaways:

- Form 8938 is a mandatory form that specified persons who are either specified individuals or specified domestic entities with specified foreign financial assets and meet the reporting threshold must file.

- If this form is filed incorrectly or not at all, serious penalties may apply.

What is the purpose of Form 8938?

Specified individuals and domestic entities use IRS Form 8938 to report specified foreign financial assets in which they have an interest greater than the appropriate threshold. This is done in order to promote tax compliance and transparency regarding offshore accounts and investments. It’s quite common for many U.S. citizens and green card holders to live and work abroad, during which time they may accumulate foreign financial assets such as company shares and pension plans. As a U.S. taxpayer, you are required to file Form 8938 to declare your interest in foreign financial assets.

Who must file Form 8938?

Specified persons who have an interest in specified foreign financial assets with a value greater than the applicable reporting threshold must file Form 8938. The term “specified persons” refers to the individuals and domestic entities listed below.

- Specified Individuals

- US Citizens

- A US resident alien for any part of the tax year

- A non-resident alien voting to be classified as a resident alien for the purpose of filing a joint income tax return

- A nonresident alien who is a bona fide resident of American Samoa or Puerto Rico

- Specified domestic entities

- A closely held domestic company whose gross income is at least fifty percent generated from passive income

- A closely held domestic corporation where at least 50% of its assets produce or are held for the production of passive income

- A closely held domestic partnership in which passive income accounts for at least 50% of its gross income

- A closely held domestic partnership is one in which at least 50% of its assets produce or are held for the production of passive income

- A domestic trust described in Section 7701(a)(30)(E) that has one or more specified persons as current beneficiaries

What foreign financial assets must be reported to the IRS?

In general, US persons and certain domestic entities must report to the IRS their interest in foreign financial assets. The following are examples of specified foreign financial assets:

- Foreign bank accounts

- Foreign investment accounts

- Foreign-issued instruments like stocks and bonds

- Foreign brokerage accounts

- Foreign financial instruments

- Foreign partnership interests

- Foreign mutual funds

- Foreign trusts

- Foreign-issued life Insurance policies

- Foreign annuity contracts with cash value

- Shares in Foreign Hedge Funds and private equity funds

What information is needed to file Form 8938?

You must provide detailed information about each foreign financial asset, which should include the following:

- Foreign bank name

- Foreign bank account number

- Foreign bank address

- Foreign bank’s highest amount from 01/01–12/31 and the year-end balance

- Owner of foreign bank

- Type of bank account (e.g., savings or checking)

- Foreign bank currency

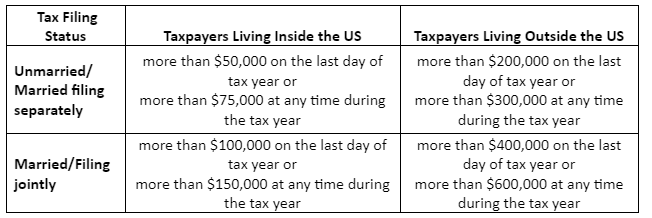

What are the reporting thresholds for specific individuals?

The applicable reporting threshold for specified individuals depends on their tax filing status and residency (living inside or outside the US). The filing thresholds for specified individuals are:

What are the reporting thresholds applicable to specified domestic entities?

A specified domestic entity must have foreign financial assets worth more than $50,000 on the last day of the tax year or $50,000 at any time during the tax year.

When is the deadline for filing Form 8938?

Form 8938 is a supplemental form to the federal income tax return for individuals (Form 1040/1040NR) and domestic entities (Form 1120, 1065). It must be submitted with your tax return by the specified deadline (extensions included) for that return. If you extend the deadline for filing your tax return, your Form 8938 will be extended as well.

Where is Form 8938 filed?

Form 8938 is filed together with the federal income tax return. You may file this electronically (e-filed) or via regular mail.

For a complete list of where to file federal income tax returns, including Form 8938 as an attachment, check here.

Why is it important to file Form 8938, and what happens if we do not file it?

When it comes to filing the necessary tax forms, it is always better to be safe than face serious consequences for failing to do so. Penalties may be imposed for failing to file on time or submitting an incomplete or incorrect Form 8938. Non-filing carries serious consequences. In very rare instances, crimes may be prosecuted.

What are the penalties for filing Form 8938 late or incorrectly?

Failure to file Form 8938 by the tax return due date, including extensions, or submitting an incomplete or inaccurate return results in a $10,000 annual penalty. If you are identified as a delinquent taxpayer, you will be given 90 days to comply. If noncompliance continues despite notification from the IRS, there will be an additional $10,000 fine for each 30-day period (or fraction thereof) up to $50,000 (in addition to the initial $10,000 standard fine).

If your jaw drops when you see such high amounts, it will probably drop even lower when you learn that, according to the IRS, “underpayments of tax attributable to non-disclosed foreign financial assets will be subject to an additional substantial underpayment penalty of 40%.”

Where can I get the most recent version of Form 8938 and its instructions?

The most recent version of Form 8938, as well as the instructions, are available on the IRS website.

How is Form 8938 prepared and filed?

Form 8938 must be attached to page 1 of the federal income tax return, including all extensions. It consists of six parts, each of which must be filled out accordingly.

- Part 1: Summary of financial accounts

- Part 2: Summary of other types of financial assets (e.g., stocks, bonds, and other financial instruments)

- Part 3: Summary of income derived from foreign financial assets

- Part 4: Summary of any financial assets exempt from Form 8938 as they are already being reported in another part of the return

- Parts 5 & 6: Further details on the foreign accounts and financial instruments

Consult the IRS’s instructions for detailed instructions on how to fill out Form 8938.

What are the common errors in preparing Form 8938?

- Filing a tax return in order to file Form 8938. Filing Form 8938 is only required if you are required to file a federal tax return for the year. Even if the value of your specified foreign financial assets exceeds the appropriate reporting threshold, you do not have to file Form 8938 if you are not required to file an income tax return for the year.

- Including assets in which you have no interest. Form 8938, in contrast to the Report of Foreign Bank and Financial Accounts (FBAR), only lists assets in which the taxpayer has an interest.

- Applying domestic thresholds to taxpayers who are foreign residents. When compared to the thresholds for US residents, the thresholds for foreign residents are substantially higher. Even if they did not meet the applicable threshold, applying domestic thresholds to foreign residents would necessitate the filing of Form 8938.

- Not reporting all required foreign assets. Form 8938 may require you to list a variety of assets that are commonly missed, including the following:

- Retirement Accounts

- Foreign Entities (subject to Forms 8865 and 5471)

- Foreign Investment Funds

- Foreign Life Insurance

- Not filing on time or amending without “Reasonable Cause” or amnesty

If you missed the deadline for filing Form 8938 for prior years, you are out of compliance. When a taxpayer fails to comply, they may face fines and penalties.

The IRS provides numerous amnesty, voluntary disclosure, and delinquency procedures to help taxpayers reduce, minimize, or avoid penalties. It is best to be aware of these in order to maximize your tax benefits. You may refer to this video for a step-by-step guide on how to prepare Form 8938.

Need help with filing Form 8938? We’re here for you!

If your company is required to file this form, we can do so for a small, flat fee to keep you from incurring fines that cost an arm and leg. Because there are severe penalties for incorrectly filling out this form, preparing it without subject-matter expertise is risky.Because there are severe penalties for incorrectly filling out this form, preparing it without subject-matter expertise is risky.

CLEER provides Federal Income tax preparation, which includes your Form 8938. We also provide comprehensive all-in-one monthly accounting packages that include monthly statements as well as your federal and state tax returns. If you have any questions about filing Form 8938 or your other filing requirements, schedule a consultation with us to discuss it further.