What is Form W-7?

Form W-7 is a crucial document issued by the Internal Revenue Service (IRS) for individuals who need to apply for an Individual Taxpayer Identification Number (ITIN). This form is specifically designed for non-U.S. citizens who are required to have a taxpayer identification number for tax-related purposes but are ineligible for a Social Security Number (SSN). The ITIN plays a vital role in ensuring tax compliance for non-citizens, allowing them to fulfill their U.S. tax obligations, claim tax benefits, and participate in various financial activities.

Why is Form W-7 Important?

Form W-7 is essential for several reasons:

- Tax Compliance for Non-Citizens: Non-citizens who do not qualify for an SSN can use Form W-7 to obtain an ITIN, which is necessary for filing U.S. federal tax returns and reporting income from U.S. sources. This ensures they meet their tax obligations and avoid potential penalties.

- Access to Tax Benefits: Obtaining an ITIN through Form W-7 allows individuals to access specific tax benefits, such as tax treaty benefits or eligibility for certain tax credits that would otherwise be unavailable.

- Facilitating Financial Activities: An ITIN is also useful for non-tax purposes, such as opening bank accounts, securing loans, or conducting business transactions within the U.S.

- Compliance with Tax Treaties: For non-resident aliens, Form W-7 is necessary when claiming tax treaty benefits, ensuring proper tax treatment under international agreements.

- Legal Status Verification: While an ITIN does not affect immigration status, it serves as a legitimate form of identification for tax purposes, helping to establish a paper trail for non-citizens living and working in the U.S.

Who Needs to File Form W-7?

Form W-7 must be filed by individuals who meet specific criteria, including:

- A nonresident alien individual claiming reduced withholding under an applicable income tax treaty for which an ITIN is required.

- A nonresident alien individual not eligible for an SSN who is required to file a U.S. federal tax return or who is filing a U.S. federal tax return only to claim a refund.

- A nonresident alien individual not eligible for an SSN who elects to file a joint U.S. federal tax return with a spouse who is a U.S. citizen or resident alien.

- A U.S. resident alien (based on the number of days present in the United States, known as the substantial presence” test) who files a U.S. federal tax return but who isn’t eligible for an SSN.

- A nonresident alien student, professor, or researcher who is required to file a U.S. federal tax return but who isn’t eligible for an SSN, or who is claiming an exception to the tax return filing requirement.

- An alien spouse claimed as an exemption on a U.S. federal tax return who isn’t eligible to get an SSN. A spouse can be claimed as an exemption only for tax years prior to 2018.

- An alien individual eligible to be claimed as a dependent on a U.S. federal tax return but who isn’t eligible to get an SSN. Your spouse is never considered your dependent. For more information about whether an alien individual is eligible to be claimed as a dependent on a U.S. federal tax return, Dependents can be claimed as exemptions only for tax years prior to 2018.

- A dependent/spouse of a nonresident alien U.S. visa holder who isn’t eligible for an SSN. Dependents and spouses can be claimed as exemptions only for tax years prior to 2018. Note. The deduction for personal exemptions was suspended for tax years 2018 through 2025. For tax years beginning after 2017, spouses or dependents aren’t eligible for an ITIN, unless they are claimed for an allowable tax benefit. The individual must be listed on an attached U.S. federal tax return with the schedule or form that applies to the allowable tax benefit.

Are there penalties for non-compliance, lateness, or errors?

If an ITIN is not obtained or renewed in time, and a tax return is filed with an expired ITIN, there may be delays in processing the tax return, which could affect refunds or tax credits.

Additionally, without a valid ITIN, individuals may not be able to claim certain tax benefits or credits that require a valid taxpayer identification number.

What documents are required for Form W-7?

Whether you are applying for a new ITIN or renewing an existing ITIN, you must provide documentation that meets the following requirements.

- You must submit documentation to establish your identity and your connection to a foreign country (“foreign status”). Applicants claimed as dependents must also prove U.S. residency unless the applicant is from Canada or Mexico, or the applicant is a dependent of U.S. military personnel stationed overseas.

- You must submit original documents, or certified copies of these documents from the issuing agency, that support the information provided on Form W-7. A certified copy of a document is one that the original issuing agency provides and certifies as an exact copy of the original document and contains an official stamped seal from the agency. You may be able to request a certified copy of documents at an embassy or consulate. However, services may vary between countries, so it’s recommended that you contact the appropriate consulate or embassy for specific information.

- The documentation you provide must be current (that is, not expired).

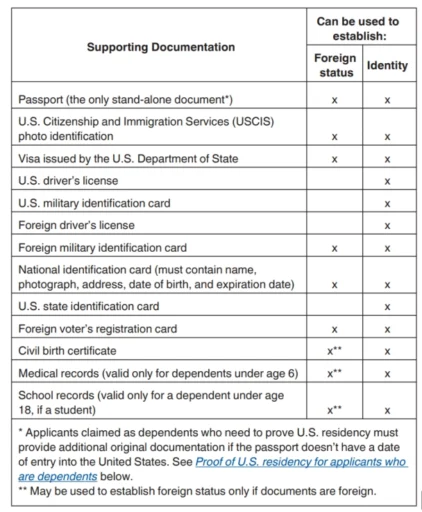

There are 13 acceptable documents, as shown in the following table. At least one document must contain your photograph unless you’re a dependent under age 14 (under age 18 if a student). You may later be required by the IRS to provide a certified translation of foreign-language documents.

How to file Form W-7

How To Apply

- Your completed Form W-7. You can refer to the instructions for Form W-7 on the IRS website.

- Your original tax return(s) for which the ITIN is needed. Attach Form W-7 to the front of your tax return. If you’re applying for more than one ITIN for the same tax return (such as for a spouse or dependent(s)), attach all Forms W-7 to the same tax return. Leave the area of the SSN blank on the tax return for each person who is applying for an ITIN. After your Forms W-7 have been processed, the IRS will assign an ITIN to the return and process the return.

- Original documents, or certified copies of these documents from the issuing agency, required to support the information provided on Form W-7. The required supporting documentation must be consistent with each applicant’s information provided on Form W-7.

When To Apply

If you’re applying for a new ITIN, complete and attach Form W-7 to the front of your tax return and file your application package with your tax return for which the ITIN is needed on or before the due date for the return. If you’re unable to file your tax return by the due date, you must file an application for an extension of time to file by the due date of the return.

Failure to timely file the tax return with a complete Form W-7 and required documentation may result in the denial of refundable credits, such as the additional child tax credit (available for tax years prior to 2018) and the American opportunity tax credit if you otherwise qualify. Don’t file your tax return without Form W-7 and required documentation.

Where To Apply

Internal Revenue Service

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

What are Common Errors To Avoid With Form W-7?

Common errors associated with Form W-7, which is used to apply for an Individual Taxpayer Identification Number (ITIN), can lead to delays or rejections of the application. Here are some of the most frequent mistakes:

- Misspelled or Incomplete Names: Applicants often make errors in spelling names or leave them incomplete. It is crucial to ensure that names are spelled exactly as they appear on identity documents.

- Incorrect Date Format: The IRS requires dates to be in the format MM:DD:YYYY. A common mistake is to reverse the month and day.

- Missing or Incomplete Numbers: Failing to provide complete and accurate numbers, such as the foreign tax ID number or U.S. visa number, can lead to application issues.

- Incorrect or Insufficient Documentation: Applicants sometimes submit expired or incorrect documents. It’s important to provide original or certified copies of valid documents.

- Wrong Mailing Address: Providing an incorrect mailing address can result in lost communications or delays in receiving the ITIN.

- Duplicate Applications: Applying for a new ITIN when one has already been issued can cause rejection due to duplication.

- Missing Signatures: An unsigned form is invalid. Applicants must ensure that the form is signed by the appropriate person, especially for those above the age of fourteen.

- Failure to Indicate Reason for Applying: Not specifying the reason for applying for an ITIN on the form can lead to processing delays.

- Incorrect Foreign Status Documentation: Failing to provide proof of foreign status, such as a visa or passport, can result in application rejection.

Can Cleer help me with filing Form W-7?

Absolutely! At Cleer Tax, our dedicated team is committed to addressing the distinct requirements of your business.

We provide comprehensive tax advisory services tailored to your specific needs, covering every aspect of compliance and optimization – including helping you reduce tax liability wherever possible. Our goal is to ensure that you capitalize on every available opportunity, leaving no stone unturned when maximizing your tax benefits and minimizing any potential liabilities.

Cleer provides Corporate Income Tax Packages encompassing federal and state income tax filings for a hassle-free experience. We also offer monthly bookkeeping packages, which include your monthly statements. If you need help getting up to date on your books, we also offer support for companies that have fallen behind on their bookkeeping with our bookkeeping catch-up package.

If you need any help reducing your tax liability, schedule a consultation, or feel free to contact us.