A cash flow statement is an effective tool for assessing a company’s liquidity, operational efficiency, solvency, and overall financial health. It provides users with vital information about how money moves within a business. Understanding and interpreting these statements can help investors, managers, and other stakeholders make informed decisions.

In this article, we’ll explore the cash flow statement’s key components, calculation methods, importance, limitations, and future trends shaping the landscape of financial reporting. We will also provide practical tips to enhance your understanding and interpretation.

Key Takeaways

- An organization’s inflow and outflow of cash and cash equivalents are summarized in a cash flow statement.

- The CFS highlights a company’s cash management, including its ability to generate cash.

- This financial statement supplements the balance sheet and the income statement.

- The CFS’s primary components are cash flows from three sources: operating, investing, and financing activities.

- CFS can be prepared using either the direct method, which focuses on actual cash transactions, or the indirect method, which adjusts net income for non-cash items.

- While both methods provide cash flow data, the direct method offers a more detailed breakdown of cash inflows and outflows, whereas the indirect method focuses on net income adjustments.

- Future cash flow statement reporting trends may include developing real-time and predictive cash flow analytics, incorporating non-financial data and performance metrics, and utilizing blockchain and smart contract technology.

What is a statement of cash flow?

The cash flow statement (CFS) is a type of financial statement that provides a summary of the cash and cash equivalents (CCE) that are coming into and going out of a company. The CFS evaluates how well a company manages its cash position or generates cash to meet debt obligations and cover operating expenses. The CFS supplements the balance sheet and income statement.

Cash flow statements are crucial to financial analysis under the assumption of accrual accounting for three reasons:

- They demonstrate your liquidity. This allows you to determine your operating cash flow, if necessary. So, you know what you can and cannot afford.

- They present changes in assets, liabilities, and equity in the form of cash outflows, cash inflows, and cash held. You can think of these three categories as the core of your company’s accounting. Together, they form the accounting equation that allows you to assess your performance.

- They allow you to predict future cash flows. You can use cash flow statements to generate cash flow projections, allowing you to plan for how much liquidity your company will have. That is essential for developing long-term business plans.

The CFS has three activity sections that designate how cash can enter and leave your business.

- Cash Flow from Operating Activities refers to the amount of money earned or spent during normal business operations, which are your company’s primary revenue source through the sale of goods or services.

- Cash Flow from Investing Activities refers to the cash earned or spent from your company’s investments, such as purchasing or disposing of equipment or investing in other companies.

- Cash Flow from Financing Activities refers to the cash received or spent while financing your company’s loans, lines of credit, or contributions from owner’s equity.

Here’s a closer look at how each section works and what it means for your company.

Operating Activities

- Depicts cash flows from core business operations

- Includes collection from customers and the disbursement of payments to suppliers

- Adjusts non-cash items such as depreciation and amortization

- Highlights the cash generated or used by operations

Investing Activities

- Shows cash flows from capital expenditures and investments

- Includes the acquisition and sale of property, plant, and equipment

- Covers acquisitions and disposals of long-term assets

Reveals the cash used or generated in investment activities

Financing Activities

- Represents cash inflows and outflows from financing sources

- Includes payment of dividends, interest, and taxes

- Covers issuance and repayment of debt and equity securities

- Shows the net cash inflow or outflow from financing activities

How is cash flow calculated?

The cash flow statement can be calculated and prepared using either direct or indirect methods.

- Direct Method. This method is based on transactional data that impacted cash during the period. In other words, it looks at actual cash transactions that affected the cash balance during the period. To calculate the operation section, sum all cash collections from operating activities and subtract all cash disbursements.

- Indirect Method. This method is based on accrual accounting principles, which means the accountant records revenues and expenses as they occur rather than when cash is exchanged. This suggests that the accrual entries and adjustments cause the cash flow from the company’s various activities to differ from net income. Instead of organizing transactional data as in the direct method, the indirect method starts with the net income figure from the income statement. Then, the accountant makes adjustments to reflect the actual cash flow, taking into account accruals made during the period.

To do this, the accountant converts the net income to actual cash flow by “de-accruing,” reversing the effects of accruals. Using the income statement, they identify any non-cash expenses for the period, with the common ones being depreciation and amortization. Depreciation represents the gradual decrease in the value of an asset over time, whereas amortization is the spread of payments over multiple periods. The accountant obtains a more accurate representation of the company’s cash flow by considering these non-cash expenses.

How do the direct and indirect methods differ?

The primary difference between the direct and indirect methods of accounting for cash flow is how they present and calculate operating cash flows.

- While the indirect method begins with the net income and adjusts it to account for non-cash items and other adjustments to arrive at the net cash flow, the direct method shows actual cash inflows and outflows.

- Cash receipts and disbursements are more detailed in the direct method, making identifying cash sources and uses easier. In contrast, the indirect method provides less detail because it focuses on adjustments to net income rather than directly listing cash flows. This does not change the fact that it offers valuable insights into the relationship between cash flows and net income.

- Most companies use the indirect method. Under IFRS and GAAP, the cash flow statement must be presented using the indirect method.

- Both methods provide the same result and information about a company’s cash flows.

The choice between the two approaches frequently depends on factors like reporting requirements, ease of implementation, and the level of detail stakeholders desire.

How can I better understand and interpret the cash flow statement?

Making informed investment and managerial decisions requires a thorough understanding and interpretation of cash flow statements. By analyzing cash flow statements’ components, trends, and ratios, stakeholders can assess a company’s financial health, operational efficiency, and growth potential. The secret to becoming proficient at reading cash flow statements is constantly learning and seeking professional assistance when necessary.

When reviewing a financial statement, keep in mind the business perspective. Financial documents provide information about an organization’s financial health and status. Cash flow statements, for example, can reveal whether a business is in its early stages of development or mature and profitable. It can also indicate whether a company is in transition or declining.

Using this information, an investor may conclude that a company with a negative cash flow is highly risky. In contrast, a company with a positive cash flow is well-positioned for expansion. Similarly, a department head may examine a cash flow statement to determine how their particular department contributes to the company’s health and well-being and then use that knowledge to adjust their department’s activities. Cash flow can also influence internal decisions like budgeting and hiring (or firing) employees.

Cash flow is typically shown as either positive (the company is bringing in more cash than it is spending) or negative (the company is spending more cash than it is receiving).

Positive Cash Flow. Positive cash flow indicates that the business generates sufficient cash from operations to cover its expenses and investments. This means it has more money coming in than leaving at any given time. Having extra cash on hand is great because it frees up capital to be reinvested in the business, pay off debt, and explore growth opportunities.

However, positive cash flow does not always indicate profit. Your company can be profitable without having positive cash flow, or it can have positive cash flow but not make a profit.

Negative Cash Flow. A negative cash flow indicates that your cash outflow exceeds your cash inflow over a specific period. However, this does not necessarily imply a loss of profit. Instead, negative cash flow can be caused by a mismatch between expenditures and revenues, which should be addressed as soon as possible.

Furthermore, negative cash flow can result from a company’s decision to expand and invest in future growth opportunities. Thus, it is critical to closely examine cash flow fluctuations from one period to another, as they provide insight into the company’s overall performance.

A company’s financial health can be understood in part by examining the cash flow statement through the use of several ratios, including the following:

- The operating cash flow ratio indicates liquidity.

- Free cash flow measures financial flexibility.

- The investing cash flow ratio evaluates capital efficiency.

- The cash flow-to-debt ratio indicates solvency.

What are the cash flow statement’s limitations?

Despite being an essential tool for assessing a company’s financial health, the cash flow statement has limitations. Here are some of the fundamental limitations:

- Does not reflect future cash flows or earnings potential

- May not reflect the quality of reported earnings

- Lacks consistency and comparability due to different accounting methods

- Needs to be read in conjunction with other financial statements

What benefits does a Statement of Cash Flow provide?

IAS 7 specifies that a statement of cash flows, in conjunction with other financial statements, provides information that enables users to determine how the net assets, financial structure (including solvency and liquidity), and adaptability of cash flow timing and amounts in response to new circumstances and opportunities have changed. An entity’s capacity to produce cash and cash equivalents is evaluated using cash flow information. It allows users to create models for comparing and assessing the present value of various entities’ future cash flows.

Eliminating the impact of applying different accounting treatments to the same transactions and events enhances the comparability of operating performance reporting across entities. Historical cash flow data is frequently used to forecast future cash flows’ amount, timing, and certainty. It is also helpful for evaluating the accuracy of previous projections of future cash flows, analyzing the impact of changing prices, and examining the connection between profitability and net cash flow.

Significance of Cash Flow Statement

- It helps in business planning, decision-making, and budgeting

- Provides accountability to investors, creditors, and regulators

- Facilitates a better understanding of financial health and performance

- Enables comparison with industry peers and benchmarks

Who are the Cash Flow Statement’s users?

Cash flow states generally have two primary consumers: internal and external. Management is an internal user, while creditors and investors are external users.

- Management. Management examines the financial figures before deciding on new policies. Management can make decisions by drawing important conclusions. The cash flow statement helps them understand the financial condition, profitability, and capital structure in various ways. The CFS is used to:

- Determine the business’s earnings trend

- Forecast future sales, purchases, and expenses using historical data

- Assess the company’s liquidity position

- Assess the effectiveness of various staff members, divisions, policies, and practices

- Gather data to make varied decisions.

- Creditors. The creditors examine the financial statement to determine the reality and position of short-term liquidity. They want to know whether the company can repay its debts on time. They can easily determine this by reviewing the financial documents.

- Investors. They are the company’s founding investors. They own equity shares. They want a higher return on their investment. Profit determines dividends in full. Increased revenue leads to higher dividends and vice versa.

What are the expected trends in cash flow statement reporting?

While it may be difficult to predict specific future trends in cash flow statement reporting, the following broader trends are likely to shape its evolution:

- Integration of technology with sustainability and social impact reporting

- Inclusion of non-financial data and performance metrics

- Development of real-time and predictive cash flow analytics

- Utilization of smart contract and blockchain technology for transparency

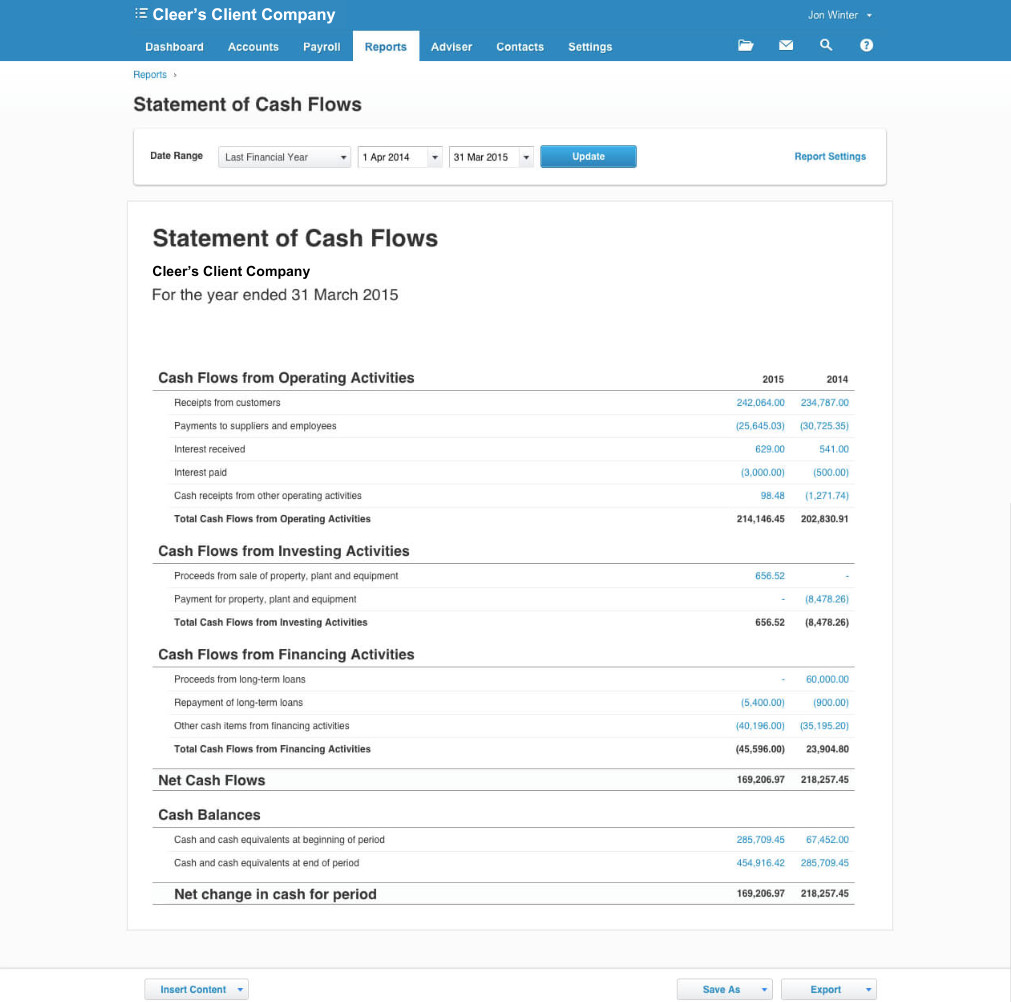

Sample Cash Flow Statement from Xero:

Read More: Streamlining Banking: Easily Connecting Bank Feeds in Xero

Cash flow statements are an essential component of business planning, decision-making, and budgeting. These statements provide management, creditors, and investors with a tool to evaluate the company’s financial performance and the company’s liquidity and solvency. Understanding and interpreting cash flow statements remains critical for stakeholders attempting to navigate the complexities of financial reporting in a rapidly changing financial environment. Stakeholders can make informed decisions and steer their organizations toward long-term growth and success by staying current on emerging trends and leveraging insights from cash flow statements.