When U.S. taxpayers engage in international transactions, particularly those involving the transfer of property to foreign corporations, it is crucial to comply with specific tax reporting requirements. Form 926, “Return by a U.S. Transferor of Property to a Foreign Corporation,” plays a vital role in ensuring transparency and compliance with U.S. tax laws. This article provides an overview of Form 926, including its purpose, filing requirements, and the consequences of non-compliance.

Key Takeaways

- Form 926 must be filed by all US citizens/residents of the U.S. which includes domestic corporations, estates, and trusts.

- Form 926 is required when property transfers to foreign corporations are in excess of $100,000 (cumulative), or if at least 10% of the stock of a foreign corporation is acquired in exchange for property held by the U.S. citizen/resident over a 12 month period.

- Form 926 is filed with the U.S. citizen/resident’s tax return.

What is Form 926?

Form 926 is a tax form used by U.S. taxpayers to report certain transfers of property to foreign corporations. Specifically, it is used to report transfers that are subject to the reporting requirements under Internal Revenue Code (IRC) Section 6038B. The form is required when a U.S. person transfers property exceeding $100,000 in value or acquires at least a 10% ownership stake in a foreign corporation in exchange for property.

The main purpose of Form 926 is to prevent tax avoidance by ensuring that U.S. taxpayers accurately report and pay taxes on transfers of property to foreign corporations. By requiring detailed disclosures, the IRS can oversee cross-border transactions and minimize the risk of income or assets being improperly shifted to foreign jurisdictions.

Who Must File Form 926?

Form 926 must be filed by various U.S. persons, including:

- U.S. Citizens and Residents

- Domestic Corporations

- Trusts and Estates

Partnerships, however, do not file Form 926 directly. Instead, each individual partner must file the form with their personal tax return if they meet the filing requirements.

What are the Filing Requirements for Form 926?

Form 926 must be filed with the taxpayer’s annual tax return for the year in which the property transfer occurs. The form requires detailed information about the transfer, including the type and value of the property, the identity of the foreign corporation, and the taxpayer’s ownership interest. There are specific thresholds and exceptions, such as transfers of cash under $100,000, which may not require filing.

What is the Due Date for Form 926?

The due date for Form 926 varies depending on the taxpayer’s business structure:

| Business Structure | Due Date |

| C-Corporations | 15 April or 15 October (if an extension was filed) of any respective year. Form 926 accompanies the filing of Form 1120. |

| S-Corporations | 15 March or 15 September (if an extension was filed). Schedule O accompanies Form 926 accompanies the filing of Form 1120-S. |

| Sole Proprietorships/Individuals | 15 April or 15 October (if an extension was filed) of any respective year. Form 926 accompanies the filing of Form 1040. |

| Trusts | 15 April or 2 October (if an extension was filed) of any respective year. Form 926 accompanies the filing of Form 1041. |

| Estates | 15 April or 2 October (if an extension was filed) of any respective year. Form 926 accompanies the filing of Form 1041. |

Which Property Does Form 926 Cover?

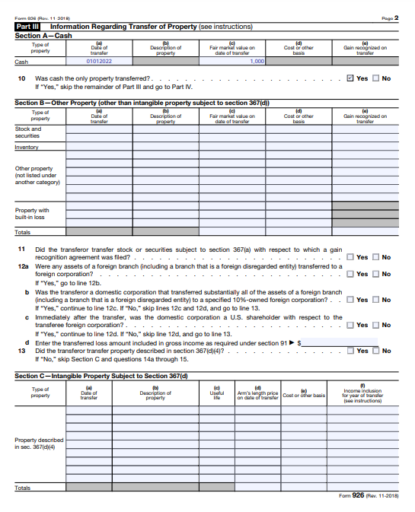

- Cash;

- Intangible property;

- Eligible property:

- Tangible Property;

- Working interest in Oil and Gas property;

- Financial assets (securities, commodities, etc.);

What are the Penalties for not Filing Form 926?

In the event that Form 926 is not filed along with the annual return of the taxpayer, the IRS can impose a 10% penalty on the market value of the property up to a maximum penalty of $100,000. However, if the failure to file is due to intentional disregard, the penalty can exceed this limit. It is crucial for taxpayers to ensure compliance to avoid these significant financial consequences.

How to Fill Out Form 926

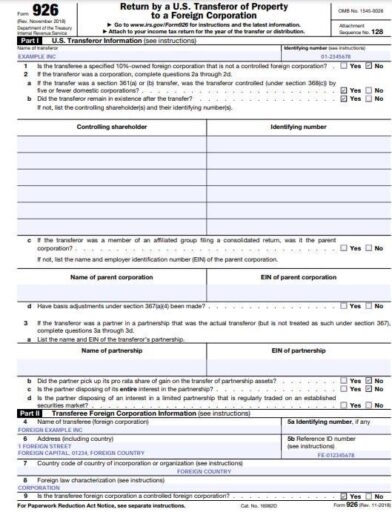

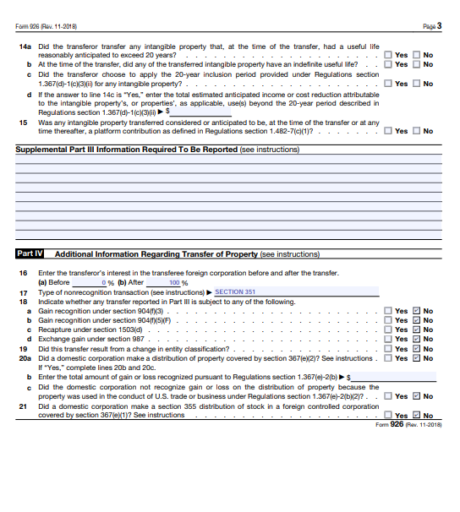

Completing Form 926 requires accurate reporting of the details of the transaction. For example, if a C-Corporation, such as Example Inc., acquires 100% of the shares of Foreign Example Inc. by purchasing 1,000 common shares for $1,000, this transaction must be reported on Form 926, including the specifics of the property transfer and the ownership details.

Can Cleer Help Me With Filing Form 926?

Absolutely! At Cleer Tax, our dedicated team is committed to addressing the distinct requirements of your business.

We provide comprehensive tax advisory services tailored to your specific needs, covering every aspect of compliance and optimization – including helping you reduce tax liability wherever possible. Our goal is to ensure that you capitalize on every available opportunity, leaving no stone unturned when maximizing your tax benefits and minimizing any potential liabilities.

Cleer provides Corporate Income Tax Packages encompassing federal and state income tax filings for a hassle-free experience. We also offer monthly bookkeeping packages, which include your monthly statements. If you need help getting up to date on your books, we also offer support for companies that have fallen behind on their bookkeeping with our bookkeeping catch-up package.

If you need any help reducing your tax liability, schedule a consultation, or feel free to contact us.